A strong history of building futures.

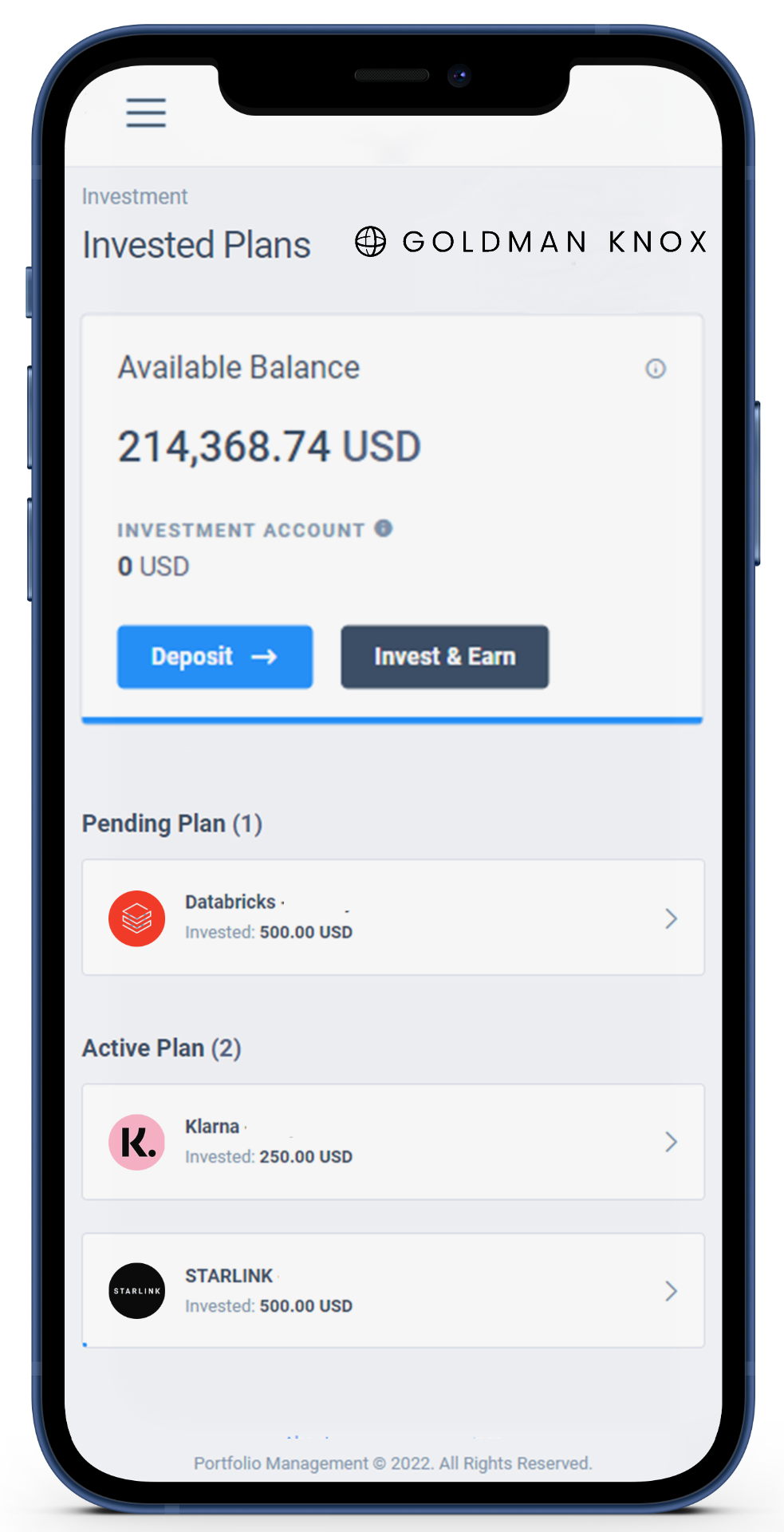

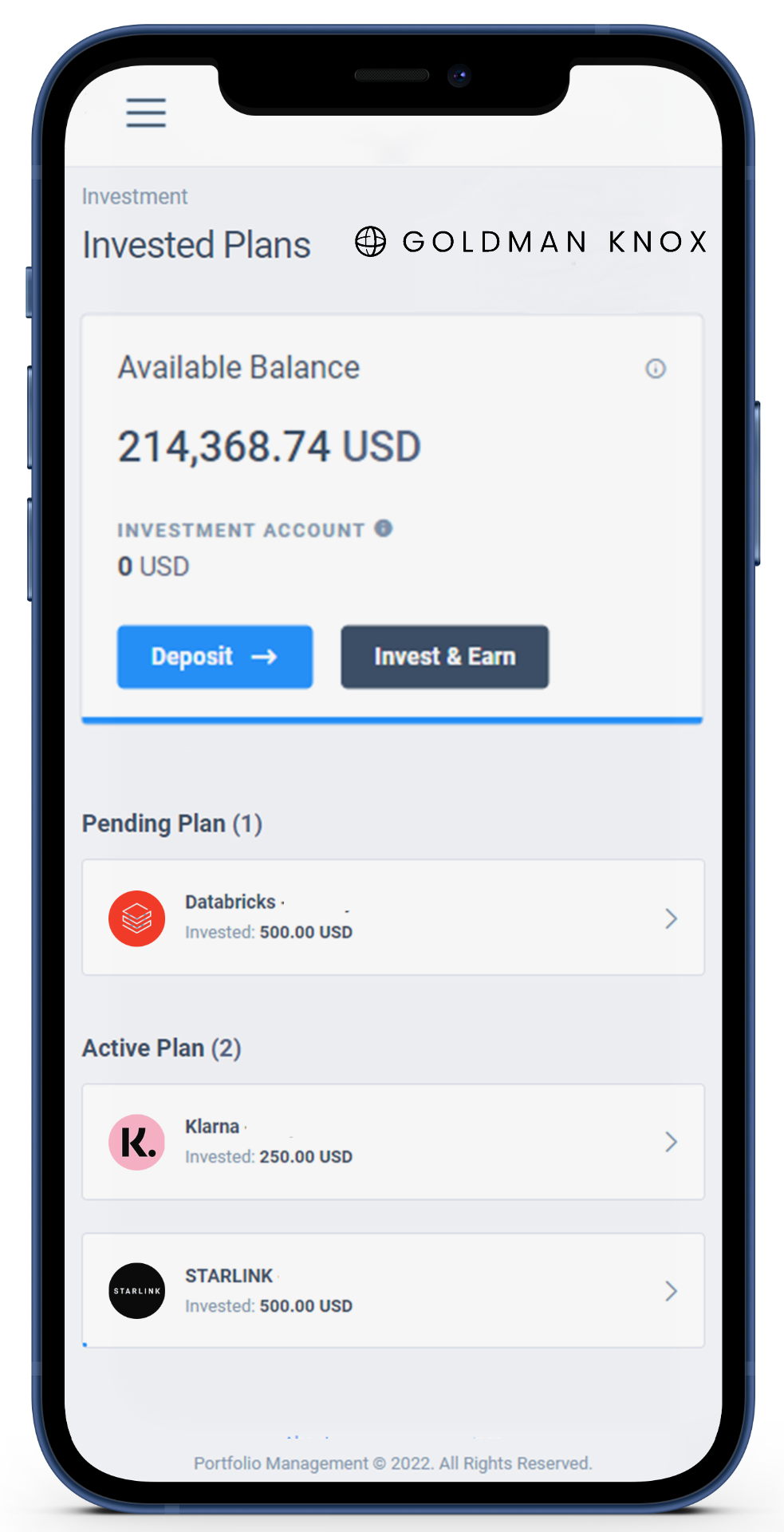

Monitor your portfolio & make investments around the globe.

Dedicated Portfolio Dashboard For Live Stocks

Monitor portfolio performance, view current holdings, investment opportunities and access exclusive Goldman Knox funds. *Requires investment in listed equities

Access Institutional Investments

Access private equity transactions, IPOs, funds and bonds that are usually reserved for institutions and high networth investors.

Extremely Competetive Fee Structure

No sales charges. No transaction fees. Simple affordable fee structures. Low all-in transparent Management Fees.

IMPORTANT:

Goldman Knox is excited to announce a forthcoming major business merger in early 2024. While specific details are under wraps for now, this development promises new opportunities, growth and innovation. Stay tuned for updates as we ensure a seamless transition. Your satisfaction remains our top priority as we embark on this exciting journey together. Thank you for your ongoing support. More information coming soon.

Own a diversified portfolio.

We were disappointed in seeing the most profitable investment opportunities only made available to institutional and high networth clients, so we created a platform where retail clients have access to these investments with affordable entry levels.

Proven Performance - Portfolio Results at a Glance

Portfolio management from Goldman Knox

Once you become a client you will gain access to your very own portfolio account manager. Your portfolio manager will offer you as much or as little advice as you require, you can keep full control or we can manage your portfolio for you, diversifying your portfolio for the perfect balance, matching your goals and appetite for risk.

* Move the slider below to see the average returns made from our fully managed portfolios.

Explore our range of funds offered exclusively to Goldman Knox clients.

Access a diversified range of investment vehicles directly held within exclusive Goldman Knox funds. Choose between private equity, IPO, stocks and digital asset funds to see returns that have far exceeded industry benchmarks.

Lower fees for bigger returns

The smart and flexible way to invest your savings

Unlimited transfers

your own name

cash balances

transaction charges